Covid-19 Pandemic and Ukraine-Russia War on Food Security

Scarcity of food has led to rising prices and both local and global markets are stressed because food demand is high while supply has been restricted.

Job losses following the COVID-19 pandemic and destruction of infrastructure and businesses, and reduced economic activities due to the Ukraine-Russia war, are the major challenges contributing to increase in prices for farm inputs.

Forced migration to countries still grappling with post-pandemic recovery has also contributed to the crisis. Loss of income makes it even more difficult for households to access food, especially against the backdrop of rising prices.

Let’s take the Ukraine- Russia war; Ukraine and Russia are both global agricultural powerhouses, accounting for a significant amount of the world’s exports of wheat, maize, oilseeds, and fertilizers.

Around the world, 26 countries sourced at least half of their wheat imports from Russia and Ukraine. Low supplies and high prices have hit these countries first, many of which are already food insecure. When it comes to maize, oil seed, and fertilizer, low supplies and high prices will have spill over effects, pushing up the prices of other commodities like farm inputs.

How is the war affecting food production?

Ukraine is the world’s largest producer of sunflower oil and, combined with Russia, it is responsible for more than half of global exports of sunflower oil (Figure 1). The region is also responsible for over a third (36%) of wheat exports (making it the world’s largest exporter of wheat). Source: WITS (2022)

Table 1: Ranking of world production of major food crops (2020)

|

Commodity |

Russia rank |

Ukraine rank |

|

Sunflower seed or cottonseed oil |

2nd |

1st |

|

Wheat and meslin |

4th |

7th |

|

Barley |

2nd |

6th |

|

Maize |

10th |

6th |

|

Fertilisers |

4th |

18th |

|

Fuel |

3rd |

n/a |

The war in Ukraine has many ramifications across the food chain. Consequences include the disruption of business operations and trade flows, higher commodity and farm input prices and a deteriorating economic outlook. The impact is trickling down to many food & agriculture companies in Europe and other continents.

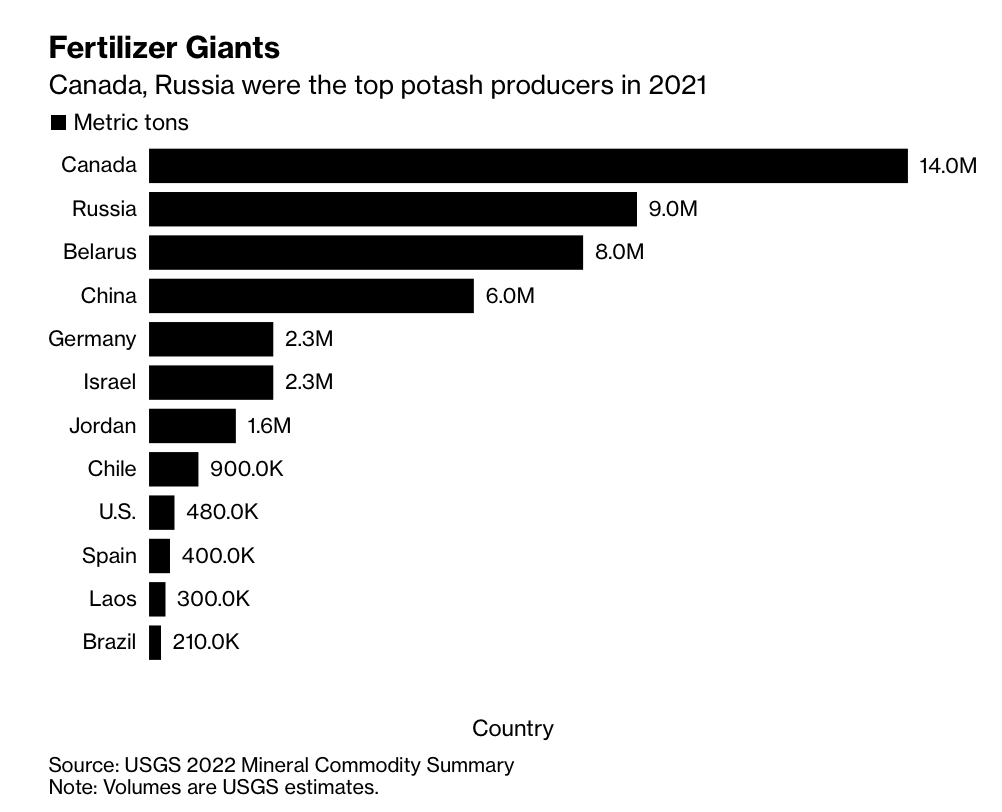

A fertilizer shortage for example has added to growing concerns about the Ukraine war’s impact on the price and scarcity of certain basic foods. Combined, Russia and Belarus had provided about 40% of the world’s exports of potash (common name given to a group of minerals and chemicals that contain potassium (chemical symbol K), which is a basic nutrient for plants and an important ingredient in fertilizer). Further, in February, a major Belarus potash producer Belaruskali declared force majeure — a statement that it wouldn’t be able to uphold its contracts due to forces beyond its control.

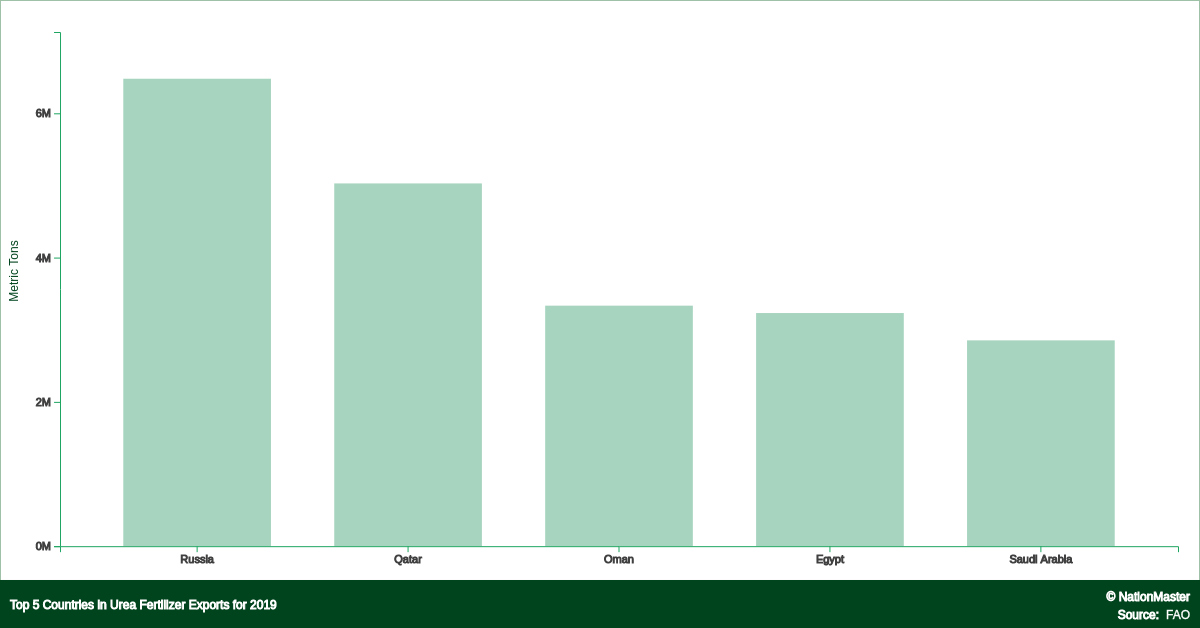

Russia also exported 11% of the world’s urea, and 48% of the ammonium nitrate. Russia and Ukraine together export 28% of fertilizers made from nitrogen and phosphorus, as well as potassium, according to Morgan Stanley.

Disruptions of those shipments due to sanctions and war has sent fertilizer prices skyrocketing. High grain prices are rising even more and this is going to affect the cost of production.

Agriculture has absolutely been hit. Farmers are going to get hurt because per acre they’re going to pay a lot more. They’re going to get lower yields simply because they’re economizing, grain shortages will drive up the cost of basic foods and other commodities which is going to lead to higher input costs for producing everything from grains, vegetables and fruits. The input costs are higher now because scarcity is looming that bids the price up as well.

While the ripples will be felt by farmers all over the world, the squeeze on food supplies will land hardest on families in third world countries. It could hardly come at a worse time.

Conclusion

These recent developments have highlighted the need for alternative strategies for saving on such inputs. The present trend indicates a growing inclination to find low-cost but effective alternatives that could produce high yields. In principle, there is no clear-cut conclusion over any alternative approach to that but farmers are still grappling with the unknown state of limbo they have found themselves in. Hopefully there will be a solution in the long run, but one thing remains for sure, hold the beams tight because it is going to be a bumpy ride!